Bull Vs Bear Market

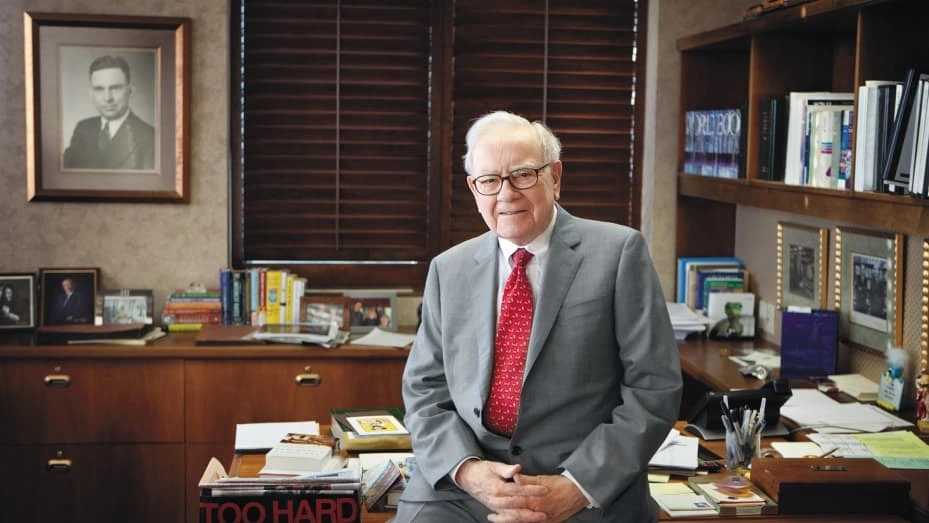

Investors like Warren Buffett’s advice are a great source of inspiration. Through the financial world, she puts meteor climbing buffets into the rare air. He has more investment experience than life experience and is currently the fifth richest person in the world today at the age of 92.

In short, Buffett is an ideal role model for aspiring investors. Here’s his advice on how to make money in the stock market. Warren Buffett’s advice is “Keep the good stock for a long time”

Warren Buffett Investment Advice

Warren Buffett’s stock advice is, “To invest is to choose good stocks at a good time and stick with them as long as they remain good companies.” Three important lessons are packed into that sentence.

First, investors find good stocks, this means businesses with a sustainable competitive advantage, solid financials, and strong growth prospects. Second, evaluation always matters. A good stock at a time but a bad price is often a bad investment. Third, investors should hold good stocks through the big bull of the Indian stock market and bear market, selling only when their investment thesis breaks down or they need money.

A Bear Market is a Particularly Good Time to Buy Shares.

When it rains like this, it is important that we go out with washtubs, not spoons. Indeed, the financial world today is full of fear. High inflation and rising interest rates have left investors worried about a potential recession, and those concerns sent the S&P 500 to a bear market last year.

But the S&P 500’s futures price-to-earnings ratio is currently 17.1, well below the 10-year average of 17.3. This means that many stocks are currently trading at a discount from their historical valuations. here you can see Warren Buffett’s best investments.

Also Read: What is IPO? – Benefits of Investing in IPO

Warren Buffett Top Stocks List:

| STOCK | NUMBER OF SHARES OWNED | VALUE OF STAKE |

|---|---|---|

| Apple | 915,560,382 | $139.7 billion |

| Bank of America | 1,032,852,006 | $36.5 billion |

| Chevron | 167,353,771 | $27.3 billion |

| American Express | 151,610,700 | $26.9 billion |

| Coca-Cola | 400,000,000 | $24 billion |

| Occidental Petroleum | 278,210,498 | $16.9 billion |

| Kraft Heinz | 325,634,818 | $13 billion |

| Moody's | 24,669,778 | $7.4 billion |

| Activision Blizzard | 52,717,075 | $4.1 billion |

| BYD | 130,327,642 | $3.8 billion |

Investors like warren buffet should buy S&P 500 Index Funds. In his 2013 shareholder letter, Warren Buffett’s advice

stated that most non-professional investors should avoid buying individual shares. Instead, he recommended “buying a cross-section of businesses that are bound to perform well overall.” He also said that the S&P 500 Index Fund will achieve that goal.

Berkshire owns shares of two S&P 500 index funds: Vanguard S&P 500 ETF (VO 0.40%) and SPDR S&P 500 ETF (SPY 0.38%). Both index funds track 500 large-cap U.S. stocks that are spread across all 11 market segments.

This allows investors to diversify into a variety of blue-chip U.S. businesses. Vanguard ETFs have a low expense ratio, but are a good option either, especially for investors who want to avoid the homework that comes with owning individual shares.

Buying an S&P 500 index fund is similar to buying a piece of the U.S. economy, and Warren Buffett’s advice

sees it as a compelling option. His 2015 letter to shareholders offered this explanation: “Betting against the U.S. for 240 years has been a terrible mistake, and now is not the time to start.” America’s golden swans of commerce and innovation will continue to lay more and more eggs. Buffett echoed those sentiments in his latest shareholder letter, noting that he had not yet seen a time when it made sense to bet against the US.

Should You Invest $1,000 in the Vanguard S&P 500 ETF Right Now?

Before you consider the Vanguard S&P 500 ETF, you’ll want to hear it. The Motley Flower Stock Advisor analyst team just revealed that they believe there are 10 best stocks for investors to buy right now… And the Vanguard S&P 500 ETF wasn’t one of them. Stock Advisor is an online investment service that has beaten the stock market by 3 times since 2002*.

Also Check: 45+ Upcoming Latest IPO 2024 List

Follow Force Newz on Facebook, Instagram, and Linkedin, for the latest updates on the Share Market, Accounting & Billing, Banking, Crypto Currency, & Tax & GST

Leave feedback about this