What is billing in accounting?

Billing in accounting refers to the process of creating and issuing invoices to customers. This can be done manually, through an automated system, or a combination of both. The goal of billing is to generate revenue for the company while ensuring that customers are correctly charged for the products or services they have received.

There are a number of factors that go into creating an invoice, including the type of product or service, the quantity, the price, and any applicable taxes. The invoice must be accurate and reflect the terms of the sale in order to avoid any misunderstandings or disputes down the road.

It’s important to note that billing is not just the responsibility of the accounting department. Sales staff also play a role in issuing invoices and ensuring that customers are charged correctly. This can be done through regular follow-ups or by providing customers with detailed invoices upon request.

In order to create an accurate billing system, it’s important to have a good understanding of the company’s products and services, as well as the applicable taxes in each jurisdiction. There are also a number of software programs that can help automate the billing process, making it easier to manage and track invoices.

Overall, billing is an important part of the accounting process and plays a key role in generating revenue for the company. By understanding the various factors that go into creating an invoice, businesses can avoid misunderstandings and ensure that customers are correctly charged for the products or services they receive.

Also read: What is Software Development?

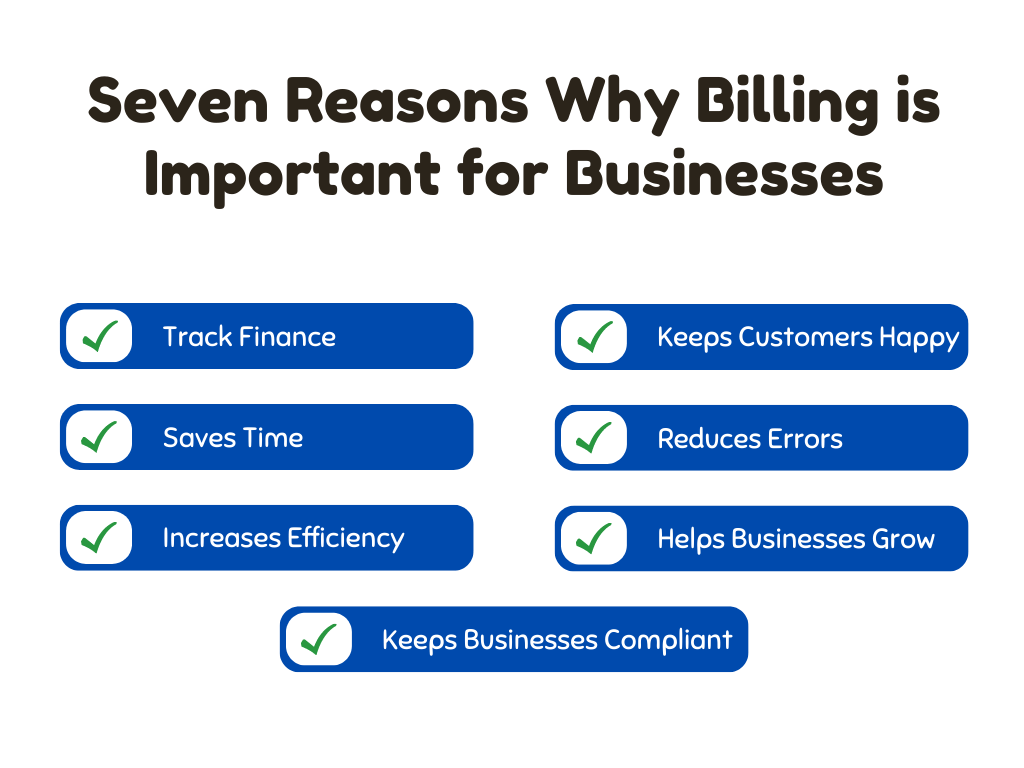

Why billing is important for businesses?

Businesses, both small and large, need to have an accurate and efficient billing system to ensure that they are able to keep track of their finances. Without proper billing, businesses can lose money and customers. Here are seven reasons why billing is important for businesses:

- Helps businesses keep track of their finances – When businesses have a good billing system in place, they can easily see where their money is coming in and going out. This helps them make better financial decisions and keeps them from overspending.

- Keeps customers happy – Customers want to be billed accurately and on time. When they’re not, they’ll likely take their business elsewhere.

- Saves time – A good billing system can save businesses a lot of time. With all of the information in one place, businesses don’t have to waste time looking for invoices or other documents.

- Reduces errors – When businesses use a billing system, they can reduce the number of errors that are made. This leads to happier customers and more accurate financial records.

- Increases efficiency – A good billing system increases the efficiency of businesses. When everything is organized and in one place, businesses can get things done faster and more efficiently.

- Helps businesses grow – As businesses grow, their billing needs will change. Having a good billing system in place from the start will help businesses keep up with their growth and avoid any issues down the road.

- Keeps businesses compliant – In order to stay compliant with the law, businesses need to have an accurate billing system in place. This ensures that everyone is paying their fair share and that the business is operating legally.

Billing is an important part of any business. By having a good billing system in place, businesses can save time and money, while keeping their customers happy and their finances in check.

Also check: What is Stock Market Trading?

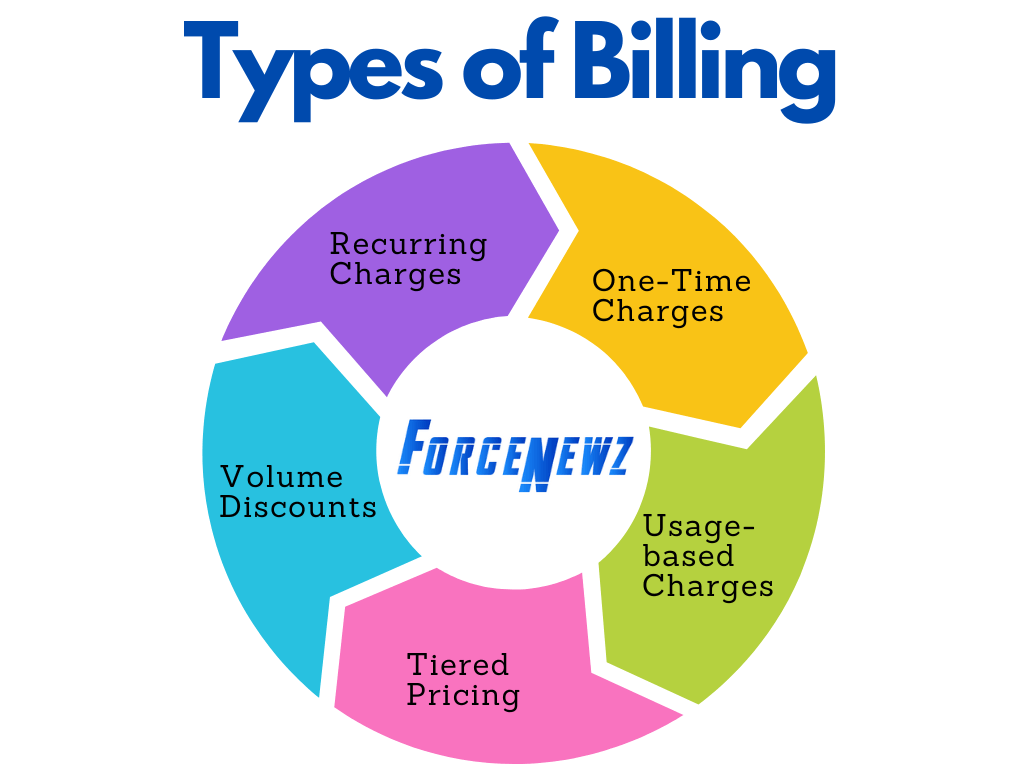

Different Types of Billing

Invoicing can be done in a variety of ways, depending on the type of business and the products or services being billed for. The different types of billing are listed below:

- Recurring charges: These are charges that occur on a regular basis, such as monthly subscription fees. Recurring charges are typically set up as automatic payments, so the customer is not invoiced each time a payment is due.

- One-time charges: These are charges for products or services that are not part of a regular subscription or service agreement. One-time charges may be for items such as setup fees, equipment rental, or professional services.

- Usage-based charges: These are charges that vary based on the amount of usages, such as long-distance charges or pay-per-view charges.

- Tiered pricing: This is a type of pricing where the customer is charged different rates based on the level of usage. Tiered pricing is common in utility billing, such as for electricity or water.

- Volume discounts: This is a type of pricing where the per-unit price decreases as the quantity increases. Volume discounts are often used to encourage customers to purchase larger quantities of a product or service.

No matter what type of business you have, it’s important to choose a billing method that will work best for your customers and your business. The most important thing is to be clear and consistent with your billing, so your customers know exactly what they’re paying for.

Also check: Top 20 Online Book Reading Apps

Top 7 Billing and Accounting Software

There are many different billing and accounting software programs on the market, so it can be difficult to choose the right one for your business. Here is a list of 7 popular billing and accounting software programs to help you make a decision:

1. QuickBooks

QuickBooks is one of the most popular accounting software programs for small businesses. It offers a variety of features to help you manage your finances, including invoicing, expense tracking, and financial reporting. QuickBooks also integrates with other business software programs, such as CRMs and POS systems.

Website: https://quickbooks.intuit.com/

Support: https://quickbooks.intuit.com/learn-support/

2. FreshBooks

FreshBooks is another popular accounting software program that is designed specifically for small businesses. It offers many of the same features as QuickBooks, such as invoicing, expense tracking, and financial reporting. FreshBooks also has a built-in time tracking feature that can help you track employee hours.

Website: https://www.freshbooks.com/

Support: https://support.freshbooks.com/

3. Xero

Xero is a cloud-based accounting software program that allows you to manage your finances from any device with an internet connection. It offers a variety of features, such as invoicing, expense tracking, and budgeting. Xero also integrates with other business software programs, such as CRMs and POS systems.

Website: https://www.xero.com/

Support: https://central.xero.com/

4. Wave

Wave is a free accounting software program that offers many of the same features as QuickBooks and FreshBooks. It allows you to manage your finances online, track employee hours, and create invoices. Wave also offers a variety of reports, such as profit and loss statements and balance sheets.

Website: https://www.waveapps.com/

Support: https://support.waveapps.com/

5. Zoho Books

Zoho Books is another cloud-based accounting software program that offers a variety of features, such as invoicing, expense tracking, and financial reporting. It also integrates with other business software programs, such as CRMs and POS systems.

Website: https://www.zoho.com/books/

Support: https://www.zoho.com/in/books/support/

6. Sage 50cloud Accounting

Sage 50cloud Accounting is an accounting software program that offers a variety of features, such as invoicing, expense tracking, and financial reporting. It also includes features specifically for businesses in the construction industry, such as job costing and project management.

Website: https://www.sage.com/en-us/products/sage-50cloud/

Support: https://www.sage.com/en-us/support/

7. Microsoft Dynamics GP

Microsoft Dynamics GP is an enterprise resource planning (ERP) software program that offers a variety of features, such as invoicing, expense tracking, and financial reporting. It is designed for businesses with multiple locations or employees.

Website: https://dynamics.microsoft.com/

Support: https://dynamics.microsoft.com/en-us/support/

Choosing the right billing and accounting software can be difficult, but with this list of 7 popular programs, you’re sure to find the perfect one for your business.

Also check: 10 Benefits of the American Curriculum

Leave feedback about this